No Tax Deduction for Kitty

Wednesday, February 18, 2015 at 01:38PM

Wednesday, February 18, 2015 at 01:38PM  A cat (we call her by the generic name "Kitty") has moved into my yard and claimed the Riddlebargers as her designated cat-servants.

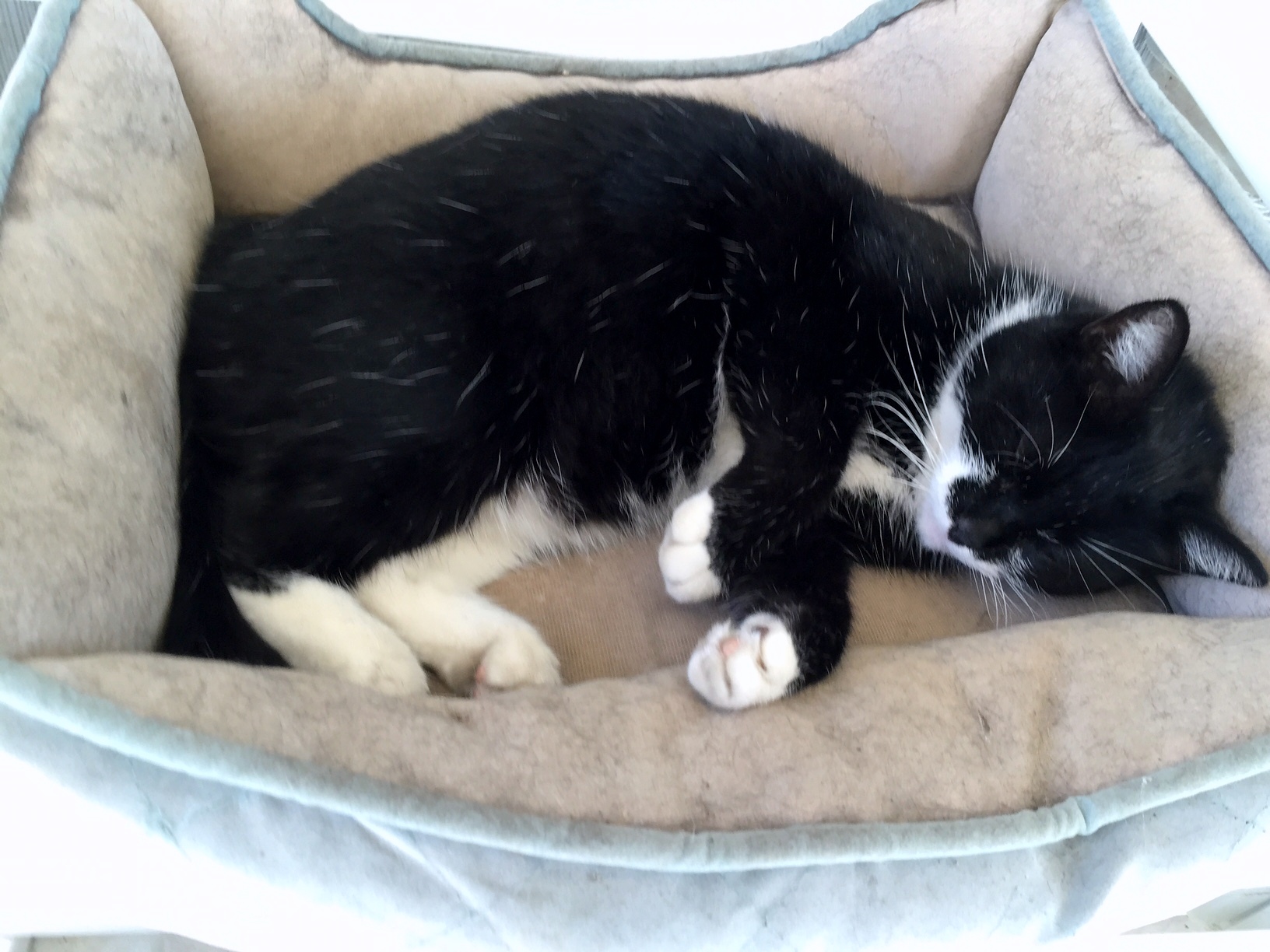

A cat (we call her by the generic name "Kitty") has moved into my yard and claimed the Riddlebargers as her designated cat-servants.

The implied agreement is that we will feed her and provide her with proper sleeping arrangements, in exchange for vermin removal. A classic quid pro quo. So far so good. She is a good hunter--I'll grant her that.

According to a recent article as to whether or not pets provide any tax relief (Tax Deductions for Pets?), it is pretty clear that keeping my current arrangement with Kitty will do nothing to lower my taxes.

Believe it or not, you can actually deduct pet expenses for five reasons--none, of course, apply to me.

1). Is your pet used as a guide animal? Well, the only thing to which this cat will guide me is her food.

2). Is your pet a guard animal? Yeah, right. The lazy cat just stares when the opossums show up at night to eat her food. She doesn't even hiss. I guess she figures she's trained us to provide more food for her in the morning.

3). If you move and incur expenses moving your pets. Let me just say this, if I ever move, whoever buys my house needs to know that the property comes with a cat.

4). If you participate in a pet rescue program. Well, there would be a debate about this one. Did the Riddlebargers rescue her, or did she claim us? And if I have to add another cat or two to claim the deduction, well then, I won't qualify. One cat is too many.

5). If your pet turns into a profession. How any one could make a significant income from a spayed feline who sleeps all day, who is indifferent most of the time to her caretakers, and who catches a rat, mouse, or lizard whenever she feels like it, is beyond me.

Being claimed by a cat only makes me want a dog (I miss Andy). Having a cat claim my yard as her own, certainly won't help me at tax time. But it is nice to have someone on permanent vermin duty. She stays, for now.

Reader Comments (6)

Hey Kim, if you video her catching something in the yard, put the video on Youtube and get enough views - you could make money from the ads! (Some make entire production series of their cats for big $$$!)

It could be lucrative and then your kitty's income could supplement your tax bill!

You could call the show: "Riddlekitty Strikes Again!"

No?

My wife got a bit of junk mail from Alley Cat Rescue, Inc. today. http://www.saveacat.org/ Well targeted marketing. She'll probably turn into a crazy cat lady if I die first.